Fresh bull phase or signs of bearishness?

A quick

synopsis of key events which have occurred during last 5 months summarised not

necessarily in the chronological order or order of importance:

Interest Rates and QE

ECB sets

the rate on deposits to -0.50% and announces QE starting this month (November

2019)

Fed

reduces interest rates by a quarter percentage point and announces a pause on rate

reduction in the near term.

Geo-political tensions and disruption in the

global oil supplies

A variety

of geo-political events happened related to Saudi Arabia, Turkey, Kurds, Syria

and Iran and consequent tensions may continue in the future.

There was

a drone attack on the oil facilities of Saudi Aramco which disrupted a

significant percentage of global supplies but the supplies were restored in a

short span of time.

North

Korea resumed conducting its ballistic missile tests.

Tweets, Trade War, Tariffs

Premiers

of two large economies of the world got engaged in an exchange of tweets

leading to a high volatility in the global financial markets. Twitter should be

grateful to these premiers for using its platform that drew lot of fan

following of these Premiers.

Series of

tweets and continuing trade war by way of tariffs and consequent attempt to reach

an agreement by the premiers of these countries is akin to seamless streaming

of the movie ‘Now You See Him Now You Don’t’ or Mr. India, the desi version, leading

global financial markets on the edge.

Inverted Yields

The

yields on American bonds got inverted.

Brexit

Brexit

has so far seen exit of two British Prime Ministers instead of exit of Britain

out of Euro Zone. The third Prime Minister attempting Brexit has adopted some

unconventional means for the legislation of Brexit to go through, including

holding fresh elections in December in the hope of garnering more votes for the

passage of bill and meanwhile the Brexit date has been extended by the EU to

January 31, 2020 upon request of the British PM.

Considering that the global indices and stock

markets remained unfazed by all the above global uncertainties and moved

unidirectional in the overbought zone, despite minor hiccups, it is becoming

increasingly difficult to ascertain as to what factors could keep the indices

scaling higher or what factors could be the possible trigger/s for the

bearishness of the global stock markets in the wake of bearish signs getting

developed on charts, besides visible signs of global slowdown in jobs,

economic, housing and GDP data.

Since the

markets are continuing to scale fresh highs or are being extremely close to the

recently made highs in the preceding two quarters, many financial pundits,

business channel editors and anchors advocating the ‘Buy on dips’ mantra,

Chairpersons/ Managing Directors of large banks/ Housing Finance companies, big

bull investors and many others have started predicting the emergence of a fresh

bull phase.

However in

light of the following charts, this unanimous optimism, remains a matter of discomfort:

Both Dow

Jones and Nifty have formed two ‘Hanging Man’ candlestick patterns on quarterly

charts (bearish signs). The third quarterly chart which is under completion (will

get completed by December end) on both the indices is also in the form of a

hanging man (please see the quarterly candlestick charts of both Dow as well as

Nifty elsewhere in this post below).

Nifty

While

September Quarter hanging man has given bearish confirmation (the dark real

body of the September quarter candle

covers the white real body of the preceding quarterly candle, i.e., June

Quarter hanging man), the current quarter (December quarter – under completion)

candle is also so far in the form of a white hanging man.

However

in this case there are two observations. The index (Nifty) has not been able to

cross highs of previous quarter despite announcement of a slew of stimulus

measures and there are close to a little short of two months left for the quarterly

candle to be complete before a conclusion can be drawn.

Meanwhile,

Moody’s has downgraded India’s rating from “Stable” to “Negative.”

A day

prior to the announcement of rating downgrade, Nifty formed a hanging man on

the daily candlestick charts and it was followed by a drop in the index after

announcement.

On weekly

candlestick charts, Nifty has formed a shooting star candlestick/ doji.

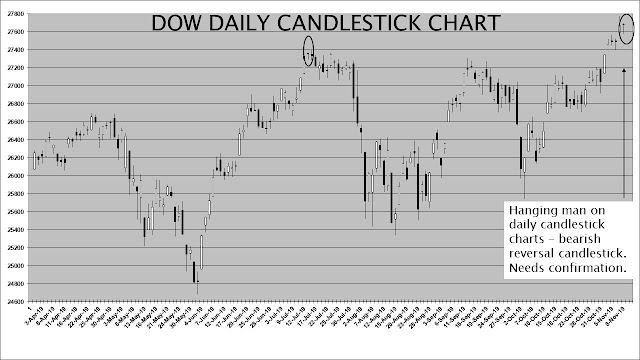

Dow

In case

of Dow, the three quarterly hanging man candles (third one under completion),

have scaled new highs one after another.

On the

last occasion, there is a formation of a hanging man on daily candlestick charts

as was formed on Nifty in the second last trading session.

Excitement in the local stock markets

On home

turf, a slew of measures providing intermediate and long-term financial

stimulus to the economy were announced by the Finance Minister on two different

occasions by way of review/ roll back of 2019-20 Central Budget provisions and

Income Tax rate cuts, bringing India at par with its South East Asian peers,

with the intent of attracting and inviting long term foreign capital. Combined

cost of these two stimulus measures is close to or exceeds Rs.2 trillion.

With the

foregoing commentary, I leave the readers to conclude for themselves the

direction that the markets are going to take.

Best

wishes for the festive season.

DISCLAIMER:

These extracts from my trading worksheets/books are

for the purpose of education only. Any advice contained therein is provided for

the general information of readers and does not have regard to any particular person's

investment objectives, financial situation or needs and must not be construed

as an advice to buy, hold and sell or otherwise deal/ trade in commodities,

currencies, indices, securities or other forms of investments. Accordingly, no

reader should act on the basis of any information contained therein without

consulting a suitably qualified financial advisor in the first place.