What do Shanghai Composite and Silver have in

common? Please read on……

Shanghai Composite’s (the most talked about index these days and which

has given jitters to the global stock markets in the fortnight gone by) latest weekly

candlestick chart has mirrored somewhat similar to the daily candlestick chart

of silver during the first four months of year 2011 (Jan 2011 to Apr 2011). The

rise and fall of both has been equally dramatic.

The worst part of the story is that since May 1, 2011, silver has been

in the grip of the bears.

At the time when silver fell, increase in margin on silver to almost

25% from the pre-implosion margin of 5% to curb any kind of volatility turned out

to be futile. Silver subsequently continuously drifted downwards with periodic sporadic

spikes.

What is bound to happen to Chinese stock market or the Chinese economy is

anybody’s guess. Perhaps the Chinese premier or the minister of finance may

also not know.

The question, whether the chart of silver will serve to be a good

reference point to take cue from as to what is about to happen to the Chinese

Economy and its consequent impact on the world economy for the next 5-6 years only

gives one Goosebumps rather than give a concrete reference.

The two decades of growth of the Chinese economy and the recent crash will

definitely serve to be the case study material in the annals of the world

economy and the economic history.

The damage caused to the US, European and Chinese stock markets was

much more in comparison to the Indian stock markets so far. But assuming that

the Indian economy is performing better and is insulated from the global

markets or shocks is like living in a fool’s paradise. Sooner or later Nifty

and Sensex will catch up with the global markets/ indices.

Currencies

The game of see-saw between Euro

& USD and the tailspin of the Indian Rupee (INR)

It is said that when the elephants fight it is the grass which suffers.

The see-saw game happening between the Euro and the USD led to rupee falling

against the both. The strength of Euro against USD was more damaging for the

INR. But does that mean that INR will keep getting weaker endlessly.

The answer is a big NO. The weakening of the INR against the USD and

Euro was caused because of the following reasons:

1.

Sudden and unexpected devaluation of Yuan

2.

Speculation and short covering

3.

Weakening of the USD against the Euro

USD/Euro multi-period candlestick chart has formed three reversal

patterns. USD is in a confirmed bearish phase against the Euro. The recent

strength of USD against Euro in the last week/ fortnight is only intermediate

in nature.

My view on the INR against the USD is as follows: USD will weaken

against the INR. Exact time of reversal, considering the present turmoil in the

global financial markets, cannot be pinpointed. However, we are very close to a

reversal.

Any long position in USD against

the imports or long-term liabilities can only prove to be suicidal because of

weakening of USD. It will be prudent to hedge the liabilities by taking a long

position in Euro.

Yuan Devaluation

During the fortnight gone by the currency markets were taken unawares

by the sudden and unexpected devaluation of Yuan against the USD. USD by itself

had gone weaker against the Euro. Devaluation of the Yuan and subsequent

reduction of interest rates by People’s Bank of China (PBC) was a knee-jerk

reaction to the falling stock market and faltering economy of People’s Republic

of China.

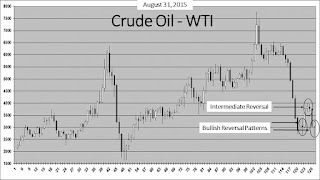

Crude Oil

Crude Oil (Western Texas Intermediate (WTI) / Light Sweet Crude Oil)

has made a bullish candlestick pattern on the multi-period candlestick chart.

Crude will remain bullish on account of the following:

1.

Intermediate pull back in the stock markets

(positive correlation with the stock markets)

2.

Positive inventory reports

3.

Weaker USD

4.

Late night news about the concern amongst the

OPEC members about low Crude prices

The above factors are expected to contribute to an upward to sideways

movement of the Crude Oil for the next one to two months.

Re-alignment of currencies

The world economic order for the next 7-8 years may lead to the

emergence of stronger currencies than USD or Euro. The falling growth rates of

PRC will have a huge impact on the economies of the US and the Euro zone and

the neighbouring countries of PRC.

http://www.bloombergview.com/articles/2015-12-01/china-invites-booms-and-busts-with-yuan-as-reserve-currency *

* Comment inserted on Dec 02, 2015

http://www.bloombergview.com/articles/2015-12-01/china-invites-booms-and-busts-with-yuan-as-reserve-currency *

* Comment inserted on Dec 02, 2015

Stock Markets

The Primary trend of the stock markets remains downwards. The

intermediate correction in this downtrend will take the stock markets in a

positive territory. Any upside in the stock markets should be used to exit the

long positions or create new short positions.

Opportunities

Close monitoring of the indices and currency derivatives in fluctuating

and volatile markets can present opportunities of paradigm shift. The hitherto

crossing of the unchartered territories by the markets during the last 7-8

years have led the global markets to the edge of future unchartered

territories.

The provision of free capital by the Fed and the US banks led to a kind

of embrace of socialism by the largest capitalistic society of the world.

May be the next 7-8 years present more opportunities to PRC to move

towards capitalism from presently being a communist country.

Disclaimer:

These extracts from my trading books are for educational purposes only.

Any advice contained therein is provided for the general information of readers

and does not have regard to any particular person's investment objectives,

financial situation or needs and must not be construed as advice to buy, sell,

hold or otherwise deal with any commodities, currencies, securities or other

investments. Accordingly, no reader should act on the basis of any information

contained therein without first having consulted a suitably qualified financial

advisor.

Contact:

The author can be contacted at riskadvisory@outlook.com

Good article. Helped with some clarity.

ReplyDeleteThanks for the feedback.

ReplyDelete