USDEUR and USDINR

With the conclusion of the recent

FOMC meeting and release of its policy decisions on October 28th at

2:00 p.m. US time, which coincides with 11:30 p.m. IST, the USD immediately

became volatile and strong against EUR and the strength of USD also reflected against

the INR the following day. Such sudden and knee jerk reactions are normally precursors

and a confirmatory signal to the change of trends. The knee jerk reactions are a

sign of reversal of positions by punters and market makers who have large exposures

and who try to reverse their positions in the minimum possible time, thereby

acting as front runners of the reversal process. In the usual course, the trend

after such policy meetings is felt reasonably between a few days to a week subsequent

to the policy decision, by which time the punters and market makers would have reversed

their positions.

Post FOMC meeting, which concluded on

October 28, 2015, I have been receiving messages with a lot of scepticism about

my previous posts related to USD wherein I had mentioned that USD is expected

to go weak against currencies of significance and wherein I had specifically presented

charts of USDEUR and USDINR.

To worsen the matter, there are

reports on internet, which speak about the near 2% yield on 10 year US

treasury, etc. which will keep USD strong. Another report speaks that the

Chinese economy is loosening and the devaluation of Yuan will not let USD go weak.

Yet another report speaks of the obsolete Phillips curve. I get confused. If I

do some more search I will perhaps get some more economic parameters and reasons

which will convince the readers that the USD will go stronger. I will further

get more confused.

In nutshell, if you combine all these

factors mentioned above, you will get something called ‘khichri’, a famous

Indian dish offered to sick people suffering from loose motions.

A very dear friend went to the extent

of saying, “You are stubborn.”

BUT I AM NEITHER STUBBORN NOR CONVINCED.

Of all the derivatives – commodities,

indices and currencies – currencies are the slowest to move. Such a slow

movement may cause a range of variations in the opinions of people having interest

in predicting currencies either because of exposures or because of profession and

at times it is really hard to determine the precise time of change in the trend.

With the objective of substantiating

my view, I am presenting a few charts again to clarify or rather magnify my

point of view.

USDEUR

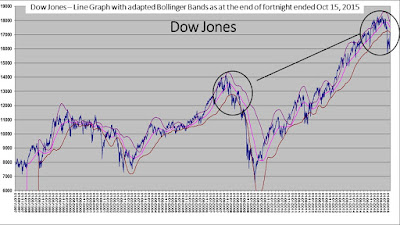

The multi-period candlestick chart of

USDEUR has made multiple reversal candles and although the close of the last

candle has been higher than the close of the previous candle, the entire last candle

is formed within the range of the previous candle. This is coupled with a confirmed

squeeze about to be completed on the line chart/ graph with adapted Bollinger

Bands. This typical squeeze is more of a bearish squeeze rather than a bullish

squeeze.

USDINR

The line graphs of Silver and USD

with appropriate moving averages for their movement cycle/ momentum and with suitably

adapted Bollinger Bands are compared in the following charts. The time periods

of the line charts are mentioned thereon. The third chart is the extension of the second line chart.

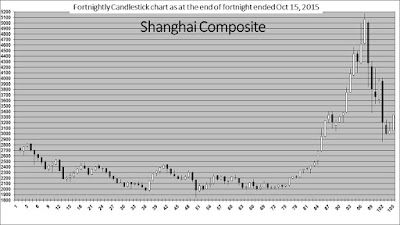

The middle, upper and lower bands of

the USDINR chart have flattened and are now in the early stage of narrowing

down, causing to initiate the formation of a squeeze. It is quite possible that

the actual USDINR rates continue to remain towards the upper end of the upper band but

the process of formation of squeeze will lead the USD to drift lower. This may

be gradual or abrupt. It is anybody’s guess.

Best wishes for the festive season.

For any clarifications please feel

free to contact.

Disclaimer:

These extracts from my trading books are for educational purposes only. Any advice contained therein is provided for the general information of readers and does not have regard to any particular person's investment objectives, financial situation or needs and must not be construed as advice to buy, sell, hold or otherwise deal with any commodities, currencies, securities or other investments. Accordingly, no reader should act on the basis of any information contained therein without first having consulted a suitably qualified financial advisor.