The panic situation

A few years back, late evening I received a phone call from an employee

of MF Global Dubai, whom I had been in touch with through an NRI acquaintance.

The guy was a Punjabi, working in Dubai and during the call, he spoke with me in the

native language as if we were long lost friends. I really felt nice. This phone

call was out of the blue and I thought to myself how good and humane this guy

was. After speaking for about 10-15 minutes in a freewheeling conversation wherein

I could not figure out the purpose of his call, he finally broke the ice and

insisted that I open an account with them and also recommend a few more clients

who could possibly open their accounts with MF Global.

I humbly told him that I was governed by the RBI rules and it wasn’t

possible for me to open an account with them and also that I didn’t know of any

other NRI who could do so.

A week to ten days later the news of MF Global going bankrupt became

public.

Such desperate, out of the blue calls to persuade new customers to open

fresh accounts to infuse liquidity in the company/ system are sure shot signs

of panic in the system. This is akin to the Ponzi/ Chit fund schemes which

overspend or which invest/ divert the members’ funds unscrupulously in the hope

of sustenance out of future subscriptions from the existing members or fresh

injection of funds by the future new members. Till the time the money keeps

flowing in everything is hunky-dory but the first sign of liquidity problems

triggers such kind of panic reactions from these brokerages or schemes to generate

fresh funds by inducting new members. Unfortunately by that time the party is

generally over and people are returning home.

The Big investment Bowl of Banks

Every time I visit the bank to deposit a cheque or for any other

reason, I am met by the ever smiling relationship manager, only with a

difference now. She spends more time with me and tries to persuade me to invest

in the newly launched investment schemes of the bank with various options

available and mind you, with full capital protection. I do not read the fine

print because I generally do not carry my reading glasses with me to the bank. When

she speaks with confidence about the booming stock market of India and the

world, and that India is more resilient in comparison to the global stock

markets, she is filled with pride towards her motherland. With such a positive

attitude she gives me an inferiority complex and makes me think twice about

what I am about to write.

Chinese Ponzi Scheme v/s Fed’s

Casino and their impact on respective Indices – Which will beat the other in

terms of speed of fall?

Enter Las Vegas and you are offered free coupons to start playing in a

casino along with free liquor and free food. If you put in your money on stake and

if you go bankrupt – and the chances are very bright that you would – you are

given a free drop home. That’s what I have been told about the casinos in Las

Vegas.

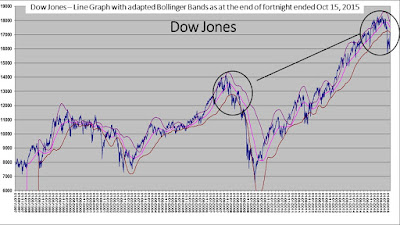

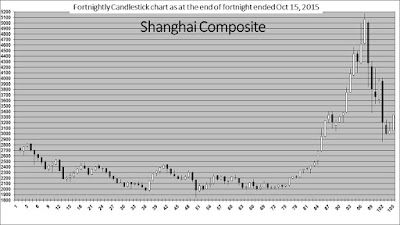

We have already seen the speed of the fall of the Shanghai Composite in

the recent past. It is now a matter of time to see how long the Dow Jones can

sustain itself and how speedier will be its fall. Will it be speedier in

comparison to the fall of the Shanghai Composite or much slower?

Why would it fall? That is what anyone would ask.

Very simple and elementary. What China did to its economy for past two

decades, the US did it in the past 7-8 years. Only the modus operandi was

different.

China kept funding the losses of State run enterprises which flooded across

the globe, billions and billions of units of cheap goods at below cost price to

attract FDI from across the globe. This is nothing but a Ponzi scheme run at

the level of a State. Alas we do not have a UN Council of Ponzi and Casino to

check such Ponzi Schemes. Even if we had one, I can bet that despite all push

and pull, India would not have got a seat there and would have got vetoed.

The US through Fed, gave away free capital through a series of QEs

(somewhat like the zero interest EMI schemes of Indian retailers to push the

sales of Apple iphones designed in the USA and made in China – subsequently

banned by the RBI a few years back; perhaps RBI realises it well that there is

no free lunch) to absorb the prior generation bad debts and the losses in the

system in one stroke after the collapse (I am just discussing the concept and

not discussing the nitty gritty of the Fed schemes) to smoothen the lives of

the millions of Americans.

So while the Ponzi Scheme of China is yet under the wraps and covers

and has manifested itself by way of crash of the Shanghai Composite, the

fallout of the Fed’s casino, played publicly over the table, is yet to manifest

itself by its impact on the US stock indices. Both the schemes did well in

terms of creating substantial public and global interest.

The Chinese Ponzi scheme was born out of the ambition and greed to kill

the global competition and be a supreme economic power whereas the Fed’s

Casinos was born out of the fear of sustenance.

The Ponzi scheme did not realise that the scheme will make the

adjoining and competing countries more healthy and fit for competition. If I

can reliably get my food and daily amenities at half the cost and in time, I

would rather focus my energies on something more creative in life and create

more competitive advantages for myself.

In the game of Fed’s casino, fresh bets were placed to cover the losses

arising out of the bets of a previous game. The Fed’s casino did not realise

that the capital will flow to the point of maximum returns across the globe

(may kindly be read as the point of riskier returns) without thinking twice as

to what if a similar fate strikes the US economy again as it did in the year

2008. What will the Fed do then? Open a fresh QE front (aka new casino) before

winding up the previous one to start a new chapter or….? May be the Fed can

shed some light on it.

The above two State run schemes give me nightmares when I think of

ecommerce companies like Amazon India, Flipkart, Paytm, Shopclues, et al, which

work on the concept of GMV (Gross Market Value) and offer deep discounts to

acquire customers. And as if the things were not bad enough for these companies,

Alibaba (aur chalees chor) is ready

to jump in the bandwagon in the quest of making more losses. Are we not running

a legalised Ponzi scheme here? They are selling the products and writing a

cheque too! Who will finally pay for the losses of these giants (remember that there

is no free lunch), who in their greed to become dominant players in the

ecommerce market of future are burning cash today?

Meanwhile here are the updated multi-period candlestick and line charts of the key stock market indices as at the end of the first fortnight of October 2015.

The multi-period candlestick charts are not yet complete for the multi-period,

however the not yet complete charts have no impact on the analysis given below.

I do not wish to sound negative but somehow I find it tough to speak

the euphemistic language of most of the market analysts simply because I am not

familiar with the jargon. These charts are important because I personally feel

that the global stock markets will not be able to sustain for long and the fall

is inevitable. I maintain my stance that the markets remain bearish with

intermediate pull backs irrespective of whether there is an interest rate hike

by the Fed or not, whether there is a QE going to be announced by China or not,

whether there is an announcement of a fresh Ponzi scheme or a new casino in the

global arena.

A Caveat

The pull backs mentioned in the foregoing paragraph might be momentous

and might give an impression of a full blown bullish wave though I assign a very

low probability of occurrence of such pull backs.

Best wishes.

Links to my previous posts:

1. What do Shanghai Composite and Silver have in common?

2. Nifty headed for.....

3. What is going to happen to the USD after this?

4. United we fall Divided we stand

5. Gold and Silver poised for Vertical Charlie

Contact:

Disclaimer:

These extracts from my trading

books are for educational purposes only. Any advice contained therein is

provided for the general information of readers and does not have regard to any

particular person's/ corporation’s investment objectives, financial situation

or needs and must not be construed as advice to buy, sell, hold or otherwise

deal with any commodities, currencies, securities or other investments.

Accordingly, no reader should act on the basis of any information contained

therein without first having consulted a suitably qualified financial advisor.

nice insight

ReplyDeleteThanks Mr. brando for taking out time to read the post. Best

DeleteThanks Mr. brando for taking out time to read the post. Best

Delete