THE

FINAL COUNTDOWN

I am publishing this

article a bit ahead of my usual schedule as I find a lot of mismatch in published

news articles and what the charts tell me.

What

The NEWS says

·

“Fed

is all set to lift off the rate cap and Fed has given assurance that the rate

increases will be gradual.”

·

“Markets

rise to give thumbs up to the Fed’s decision of gradual rate increases.”

·

“In

the minutes of the last FOMC meeting, specific phrases/ set of words have been

replaced with another set of words, which means that Fed will be compelled to

increase the interest rates in the coming December FOMC meeting.”

Such news items I keep

reading on various websites and in various articles. Various analysis have been

made and aired.

The minutes of the last

FOMC meeting are available on the net also. Given below is the link:

Honestly, for me it is

tough to interpret the words selectively chosen by Fed and somehow I get a feel

that the Fed dances to the tune of the Wall Street to carefully choose the

words to convey a message what the Wall Street wishes to listen. So much hype

is created around these two events (the FOMC meetings and the release of the

minutes) that I sometimes feel that the minutes of the meeting are virtually

dictated by the Wall Street through the hype generated through the published news

articles.

AND

What

the CHARTS foretell

The

Final Countdown

I am fascinated by the

charts and technical indicators generated by silver. Silver is considered to be

one of the most speculative and volatile commodities and the most tough to

interpret and follow. Yet I draw a lot of inspiration and references from the various

charts of silver and the technical indicators/ parameters generated by the data

of silver.

The

Markets/ Indices remain bearish

Therefore in my present

article I will draw reference from one of the old charts of silver, without

drawing any conclusive downward targets and at the same time continuing to maintain my previous stance

that the markets are bearish and also that

now the ‘Final Countdown’ has begun.

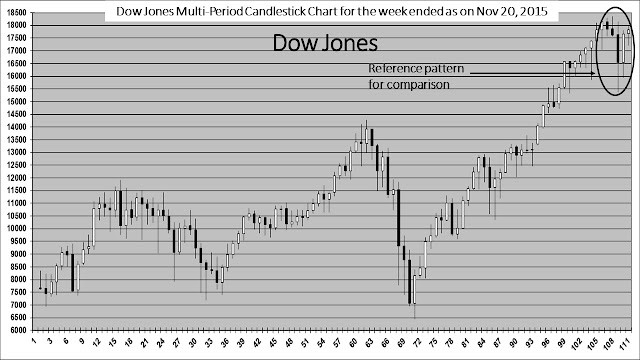

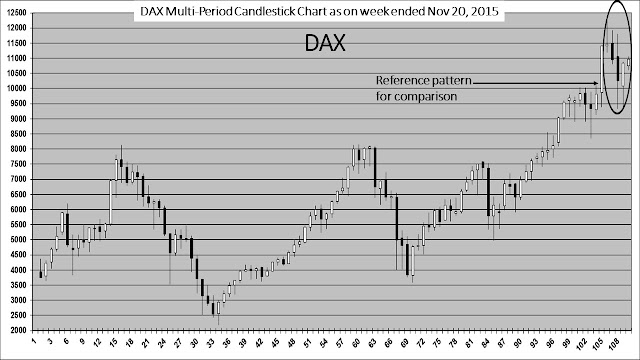

Please note that for the

multi-period charts shown below, the completion period is either approximately a

week away or about a month and a week away. Though a lot can happen in a week’s/

a month’s time, yet approx. 100 points or so up from here will not at all alter

the reference patterns and my stance. Approx. 100 points or more below the current

levels will only strengthen my stance. Moreover, during the formation of such

reference patterns, the patterns are usually not sustainable for a long period

of time and therefore their snapshot picture formation is more important than

sustainability of formation.

I do not wish to give

targets to my readers (the most common asked question from the readers of my

blog), simply because I do not drive the market. Secondly, although the past identical/

similar patterns give a good reference, yet these may or may not yield the similar

outcomes/ returns. Thirdly, the art or science of calculation of targets is

still a mystery for me. I just simply know that as a thumb rule, previous peaks offer targets or resistances.

Best wishes for the

festive season.

Contact:

The author can be

contacted at: riskadvisory@outlook.com

Disclaimer:

These extracts from my

trading books are for educational purposes only. Any advice contained therein

is provided for the general information of readers and does not have regard to

any particular person's investment objectives, financial situation or needs and

must not be construed as advice to buy, sell, hold or otherwise deal with any

commodities, currencies, securities or other investments. Accordingly, no

reader should act on the basis of any information contained therein without

first having consulted a suitably qualified financial advisor.

No comments:

Post a Comment