Year 2015 – End of an Era – The fading away of

giants

Year 2015

will mark the end of an era in the chapters of History of World Economics. Two

mighty giants – the USA and the PRC (People’s Republic of China) who grew too

big for the world economy in their quest for their economic might with combined

GDP in the region of USD 25 trillion will be gradually overshadowed by the

trailing economies, viz., the Eurozone, BRIC nations minus China, due to

slowdown in these two economies.

Well,

well, well……..

That is a

bold statement to make and who would live that long to make an assessment of

the foregoing statement. Yet let me make an attempt to support my statement.

Mistakes of the past

Sometimes

the mistakes of the past haunt you so much that they don’t let you go far.

I am

referring to the mistakes made by the US and Chinese policy makers. I shall now

be taking the specific case of the US economy.

Two

wrongs never make a right and US has just done that. Within the last ten years

the US has made two wrongs which will be severely punished by the laws of the

economics and it will take decades for the US economy to recover from the

aftershocks of the financial tsunamis that it has brought to the world. The

first one was financial crisis caused by the subprime borrowing.

The second one was to hike interest rates at an inappropriate time (it should

have done it long back) when the stock markets are in a highly speculative

zone. The second financial tsunami is underway and has just begun. The complete

wave of the US stock markets correction will determine the extent of the

aftermath of the stock markets correction.

The manipulated USD and its consequent impact

on the world economy

The USD

has been a strong yet manipulated currency since decades which has always

benefitted the US economy. A strong economy feeds the currency and vice versa.

Both feed each other so much that sometimes the cause and effect relationship is

lost. The trend finds its way to glory till the underlying weaknesses emerge

publicly.

Why has

the US economy grown while the other economies are still struggling to survive

or grow at a decent rate?

A strong

USD has hurt the growth of the world economy by causing deflation the world

over in the commodities market, whereas it has helped consumerism in the US by

way of cheaper imports.

The

policies of the Fed during the last eight year, led to channelizing of funds of the US economy to a super inflated stock market and a rigged

and manipulated currency not having adequate underlying strength. Both, the

stock markets and the currency have outlived their real strength. We have

already witnessed the bearishness of the US stock markets starting Jan 2016 and

the economic data pouring in is also not too healthy.

Turbulent US economy and the USD in times to

come

A

manipulated strong USD and the flawed policies of the Fed have led to forced consumerism in the US economy by not

giving adequate options to the US citizens to save – save for the rainy day.

The trend

of the US stock markets and the USD – supported by the flawed policies of the

Fed – have forced the world to believe in the paradigm that we have entered

into an era of negative or zero interest rates. Perhaps new laws of economics

will emerge over a period of time which I, in my personal capacity, cannot

imagine at this stage. But I do believe in the fact that the laws of cost of

capital will remain intact.

A project

cannot be made viable by lowering the cost of capital. A project remains viable

by its sheer inherent strength, strong natural demand and its economic NPV or

IRR. The stress tests on the variables of a project determine the viability and

strength of the project in times of stress and not the variability of the cost

of capital.

With a

strong and steep correction of the stock markets underway in the US, the US

economy and the USD will remain weak until cows come home, because at this

juncture the Fed and Uncle Sam are not left with much economic ammunition and

options to revive the economy.

A weak

dollar coupled with emergence of other stronger economies and currencies will

lead to the limited powers of spending of and by the US citizens and Uncle Sam,

leading to a decline in the financial might and prowess and consequent lesser

strength in the arena of world economics and other geopolitical platforms.

Consequently the USD will remain a turbulent

and unmanageable currency in times to come.

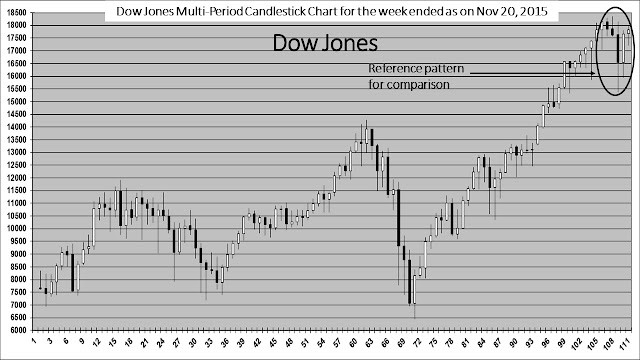

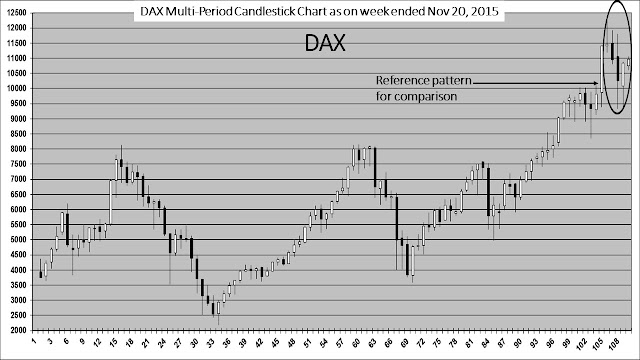

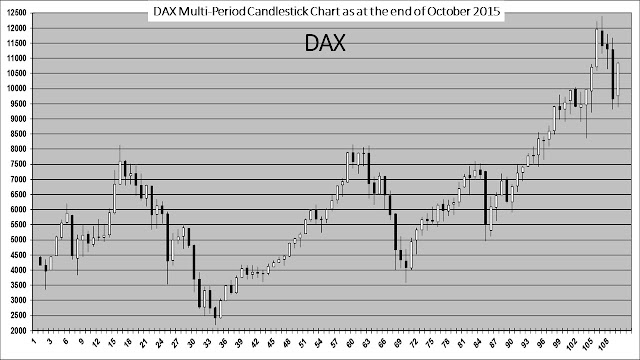

Charts of US stock market and USD

Contact:

The

author can be contacted at riskadvisory@outlook.com.

Disclaimer:

The

extracts from my trading books are for educational purposes only. No attempt is

being made to give any kind of advice to anyone. The contents are for the general

information of readers and does not have regard to any particular person's

investment objectives, financial situations or needs. Consequently the contents

must not be construed as an advice to make investments, sell, hold or

otherwise deal in any or a set of currencies, commodities or any other kind of

assets. Accordingly, no reader should act on the basis of any information

contained therein without first having consulted a suitably qualified financial

advisor.