Blame it on Fed and ECB

Since my

last post titled “The Final Countdown – Indices Special” on November 21, 2015, two

events of significance have occurred, viz.:

·

ECB

reduced deposit rates by 0.10% to negative 0.30% and announced QE amounting to

360 billion euros extended till 2017

·

Fed

chairperson’s testimony to the US Senate and persistence in view to get off the near zero interest rate tiger

in light of robust US economic and jobs data indicating adequate and continued

strength in the economy

The spontaneous

reaction of the financial markets to ECB’s decisions was clearly visible in the

currency and stock markets.

However

these events left me in a confused state of mind. The confusion arose on the

following accounts:

·

Why

is Fed hell bent to raise interest rates on 15th-16th

December 2015, when it did not raise it at times when the US economy and the

stock markets were doing so well for many years in the recent past?

·

Why

does the ECB have to reduce the deposit rates? What was the rationale behind

this move to bolster Euro and how effective will be the ECB’s bond buying

program of 360 billion euros to strengthen the Euro Zone economy?

NOW I AM CONVINCED THAT:

·

Central

Banks do make mistakes and

·

Sometimes

Central Banks make mistakes in series by their inaction/ wrong actions at wrong

times and

·

They

also:

o

Let

the blame fall on themselves, and

o

Empower

financial markets to prove that the Central Banks act wrong

Listening/

reading about Fed’s/ ECB’s statements, its actions/ inactions and listening to

the subsequent commentary of the analysts has finally kicked my spirit this

time to interpret these statements and actions.

I will

make an attempt to interpret these in my way.

A. Fed’s Decision to raise the interest rates –

Biggest Blunder by Fed as far as timing is concerned – Enjoy the roller coaster

at FeDisneyland

I admit

that the US economy is robust at this moment but the best milestone/ time to

have lifted the cap has been left way behind in time; perhaps almost two years

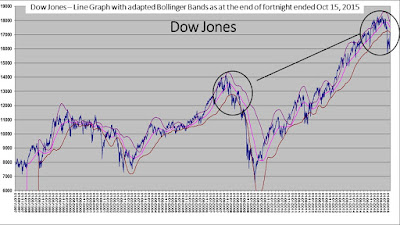

and a quarter back in time. Now that the US stock markets/ Indices are at their

peak and ripe to show some ‘Correction’, raising interest rates at this

juncture will only lead to the blame of ‘Correction’ being put on the Fed. Fed

has already sown the thoughts of ‘Correction’ with the markets.

Please

read the news article below. This article appeared on Bloomberg’s website:

“According to

October's FOMC statement, Fed officials believe "it will be appropriate to

raise the target range for the federal funds rate when …….."

According to Yellen today, she currently judges that "US economic growth ……2 percent". In short, she believes the conditions for a rate hike have been met.

Declaration came with the usual caveats: It is data dependent and a really bad November payrolls figure or some other negative shock (perhaps another dip in the stock market like we saw in August) could yet persuade the Fed to hold fire.

"We don't expect ….., so we have to assume that a rate hike is coming", says Capital Economics in a research note.

Beyond the first rate hike, Yellen stressed ………..zero. But frankly that estimate is 90% guesswork.”

According to Yellen today, she currently judges that "US economic growth ……2 percent". In short, she believes the conditions for a rate hike have been met.

Declaration came with the usual caveats: It is data dependent and a really bad November payrolls figure or some other negative shock (perhaps another dip in the stock market like we saw in August) could yet persuade the Fed to hold fire.

"We don't expect ….., so we have to assume that a rate hike is coming", says Capital Economics in a research note.

Beyond the first rate hike, Yellen stressed ………..zero. But frankly that estimate is 90% guesswork.”

My Interpretation

The Fed chairperson has handed over

the tool for not lifting the interest rate cap in the hands of the Wall Street.

·

Message for

Wall Street: When the option is available, exercise it.

In my opinion the damage is done now. Interest rate

cap lift-off could have been deferred

B. ECB’s decision of QE to the tune

of 360 billion euros

My Interpretation

No doubt

that robust stock markets support the economy. When the stock markets are highly

speculative and are due for correction, any quantum (be it “Too little” or

adequate) of bond-buying will not lead the stock markets any higher. The effort

of bond-buying program will be a waste.

The markets

reacted by saying “Too little.” Here also the tool to put the blame on ECB was

handed over by ECB itself to the markets.

In my opinion announcement of QE should have been

deferred.

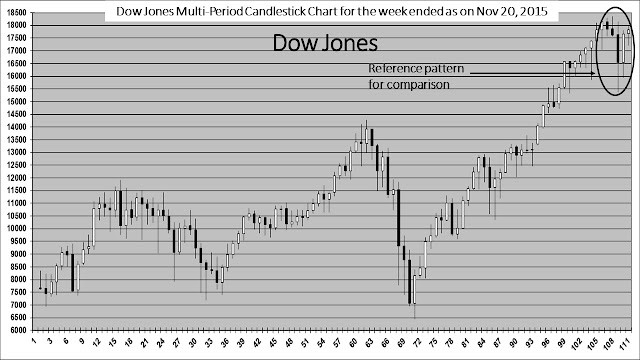

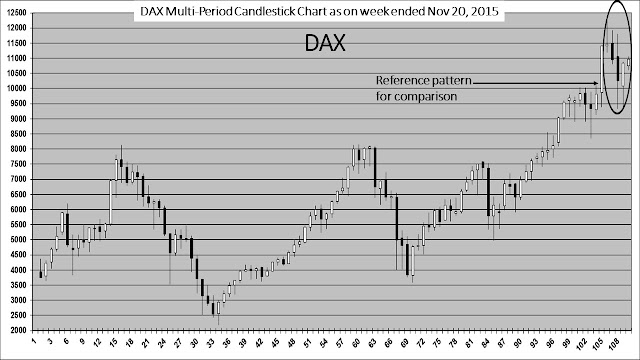

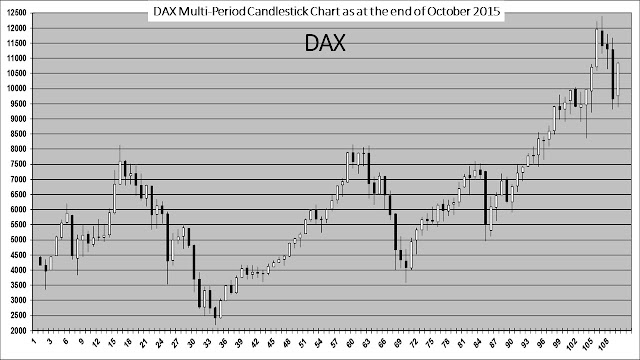

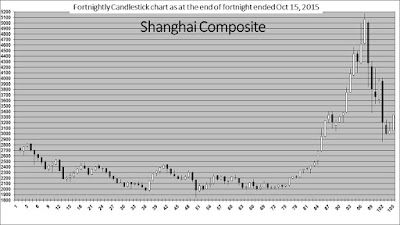

There has been no significant change in the graphs

presented in my previous post. All my previous views/ stances remain intact.

Best wishes for the festive season.

Contact:

The

author can be contacted at: riskadvisory@outlook.com

Disclaimer:

These

extracts from my trading books are for educational purposes only. Any advice

contained therein is provided for the general information of readers and does

not have regard to any particular person's investment objectives, financial

situation or needs and must not be construed as advice to buy, sell, hold or

otherwise deal with any commodities, currencies, securities or other

investments. Accordingly, no reader should act on the basis of any information

contained therein without first having consulted a suitably qualified financial

advisor.