From Petro Dollars to New Energy Currency

Recently

there was an article on the web and in the newspapers saying that a secret pact

was sealed way back in 1970s between Saudi Arabia and the US about mutual help

that the two countries will extend to each other. According to this pact US

will buy oil from Saudi Arabia and supply arms to Saudi Arabia and Saudi Arabia

in turn invest the surplus dollars in US treasuries. Here is the link to the

story for those who would be interested in understanding the details:

To me a

new story emerges from here. Now that the US is self-sufficient in oil and no

longer purchases oil from Saudi Arabia, the barter trade cannot continue and there

can be no more purchase of US treasuries by the Saudi kingdom. In fact from now

onwards the deficit of Saudi Arabia will need to be funded by sale of its

reserves in US treasuries or alternate means/ borrowings/ sale of assets, etc.

What impact can Global warming have on the Global

economy?

Now that

there are talks of the global warming and replacement of fossils based fuels by

sources of clean/ solar energy, the investments in these strong potential areas

is going to grow manifolds within the foreseeable future.

The above

indicates that if an energy product consumed on a mass scale (solar/ tidal

energy/ stored energy/ power banks) can be bartered by mass scale products/

services (be it arms and ammunitions/ clean potable water/ wheat/ coffee/

orange juice/ provision of long term consultancy/ services) of a country and

also the balance of the underlying currency payments can be reinvested in the

treasuries of the country providing the bouquet of products/ services of mass

consumption, the dynamics can tilt in favour of the currency of the country

exporting these products/ services.

That’s not

all that I wish to convey here.

How close are we to this? In which currency’s

favour is the tilt going to occur?

While the

new order may take decades to establish, its beginning may have already

started. Newer pacts will perhaps seal the fate of the pact above mentioned or

will perhaps let it not survive. The one and only factor related to the above

stated shift in paradigm which keeps unsettling me or rather keeps assuring me

or endorsing my viewpoint are the charts of the US Indices. Time has ushered in

an era where the US supremacy is going to diminish from now onwards and will

lead to a state where the strength and demand for petro dollars will also

diminish.

The

following post of mine may be read along with this article:

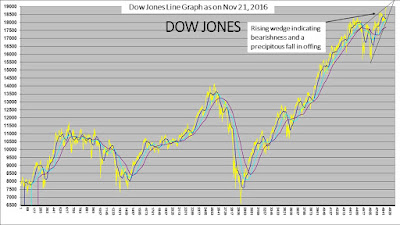

In my

above post, dated 21 November, 2015, I have compared the chart of US Indices

with the dated chart of Silver. The Dow Jones/ Nasdaq Composite have taken

another dip since the above post and also recovered subsequently forming a

Triple Top. To my knowledge, a Triple Top is a bearish pattern but I am amazed

how the resilience of the US Indices have changed the stance of many a

technical analysts who have started believing that if the indices/ markets

break certain resistances, the markets are in for a fresh bullish wave.

While I

do agree that anything can happen in financial markets, I do not put on

blinkers or follow the market/ technical analysts blindly.

The

duration of the multi-period employed in my post of November 21, the link for

which is given above, has now been extended by me in my current post. Besides

the line graphs and the newer duration multi-period adopted for the candlestick

charts, I am also presenting a unique proprietary combination of multiple (set

of three) stochastics drawing comparison between the charts of Silver and Dow.

Need I say anything more on the direction of the markets from here?

The Eccentricity of Extrapolation of the

Economists and the Statisticians

During my

graduation, one of the professors gave an example which I always cite as a

humorous analogy: “If you keep the lower half of a person in a furnace and the

upper half in a refrigerator, on an average he should be feeling fine.”

By the

same yardstick if we extrapolate the US economy and the Indian economy, the

Indian economy will reach moon sooner than the US economy.

The Frustrated Fed

Why is

the Fed hell bent on raising the interest rates? If the near zero interest

rates have taken the US Indices/ economy to the stratospheric heights, the Fed

should continue to maintain the rates. According to extrapolation employed by Fed,

the US GDP/ economy should continue to grow at a sustainable rate. Then why

should it tinker with the interest rates at this juncture?

Somewhere

deep within its heart, the different and diverse forces/ representative members

of FOMC feel that all is not well and there is something else brewing up which

is not revealed/ apparent to the common man. There are perhaps various

imbalances/ bubbles (be it an imbalance or a bubble in the stock market or

treasuries market or any other financial market) created by a single steadfast policy

decision of near zero interest rates under the guise of single steadfast

objective of the target unemployment rate (to hell with anyone/ anything else

which comes in/ on the way).

The Success of the Manipulative Market Makers

Dear Fed,

the Market Makers have succeeded to make the public believe that the

extrapolation of sustained/ projected growth rates will take the US GDP/

economy/ Market Indices to higher levels from here.

Triggers for a correction

Many

people ask me as to what would be the triggers for a correction? I tell them

that the triggers are always built in the system. It all depends upon when does

the media or the policy makers wish to make them public.

While I

am not at all trying to make an attempt to hint that the data being reported is

wrong or manipulated, all that I am attempting to say is that agencies

compiling the data have a first-hand feel of the anomalies about to happen in

the near future but these anomalies get guised under the averages or many of

the data reported are not perfect lead indicators.

Short-sightedness of a Consultant friend

A

consultant friend of mine who claims to be closely working with the government

claims that the Indian stock markets are not going to fall further. I can only

say that one cannot piss or fart against the wind. If the big daddy sneezes we

get the cold.

From Cheer to Fear

Here

below are the newer comparative charts along with the proprietary stochastics

(technical indicators) that indicate the soon to be direction of the US

Indices.

Contact:

Disclaimer:

These

extracts from my trading books are for educational purposes only. Any advice

contained therein is provided for the general information of readers and does

not have regard to any particular person's investment objectives, financial

situation or needs and must not be construed as advice to buy, hold and sell or

otherwise deal in any kind of commodities, currencies, securities or other

investments. Accordingly, no reader should act on the basis of any information

contained therein without first having consulted a suitably qualified financial

advisor.