The TRUMP Ace

A lot of

analysis must have gone into the US Presidential elections and lots of data and

statistics must have got churned to reach the voter banks of each hitherto

presidential candidates. A lot of election planks and platforms must have been

created to win the elections. That shows the winning candidate must have

appealed the majority of the voters and the Electoral College and would have

covered the majority of the population in the US to secure the majority vote.

I have a

few other concerns which are largely not talked about and yet are very critical

for any democracy and the smooth functioning of its political system and the financial

markets. These are:

1.

Is

the integrity of the Federal investigation agencies intact (without going into

the criticality of the issues raised during the presidential elections) or is

it questionable?

2.

Is

the integrity of the topmost watchdog agency of the securities market intact or

is it also questionable? Perhaps to throw its weight around it made two persons

of the Asian origin scapegoats in a peculiar case of insider trading a couple

of years back. No doubt the persons might have indulged into insider trading

but was that case a mere specimen case which was discovered and/ or widely publicised?

After that the securities markets watchdog could not catch any other single or

group of individuals indulging in insider trading?

3.

Does

the topmost securities regulator have enough teeth and wherewithal to catch the

big Financial houses who give price/ rate targets three years in advance and

then ensure that those target prices are met despite all costs (costs to the

ordinary US and global citizens) or surprisingly they are so accurate that all

their predictions are accurate to the nearest dollar and fall in place?

4.

Did

the securities watchdog ever make an attempt to eavesdrop the Fed and other market

participants and could it catch some?

5.

Is

the media really free in the US or is it projected to be free in the guise of freedom

granted to social media? Or that both operate in different domains and the

social media (aka masses) doesn’t even get a whiff of what happens in the

bigger influential circles? Or if the likes of what occurred during the

presidential elections (referring to the comments of the investigating agency)

was something which was a bolt out of the blue and got overshadowed by the

hustle and bustle of the Presidential elections.

May be

with the newly elected Prez, the America is on the harbinger of a renewed

change for the general goodness of the global economy from a holistic view point

and not just for the world’s biggest economy.

Being MODI fied

Back on

the home turf, the economy and the markets got a double whammy of the outcome

of the US Presidential elections and consequential reactions by the global

stock markets as well as the adoption of new currency notes.

At the stroke

of 8 pm (a famous IMFL), it looked as if the country got paralysed as the intoxicated

life blood of the economy got flushed out in a gush and the ensuing process of

transfusion of fresh blood in the due course of time would create some

troubles, weaknesses and also perhaps paralysis for a limited period of time.

Nonetheless the fresh blood in the long run, will heal the economy ailing with

the evils of terror and corruption and bring in pre-requisite changes for a renewed

vigour and resilience in the economy.

Generating

an expanded and larger base of the economy with the help of adoption of electronic

money and circulation of higher denomination currency notes, in my personal

opinion will lead to a rapid growth in the visible economy. This will be

revolutionary in terms of opportunities that will be available for the masses and

also the new generations entering in the business mainstream. These

opportunities will provide impetus to fresh ideation and entrepreneurial skills

through external financial assistance which should at least now be readily and

easily available from the banks and financial institutions. I also anticipate

that shrinking of the financial base will also lead to invitation of external

financing to boost infrastructure and long term projects which are the need of

the hour for the domestic economy.

And

finally my take from the entire exercise:

1.

One

must learn to read the language and the mind of the Indian Premier. The images

of new Rs.2000 notes were circulated a day or two in advance without giving the

slightest of an inkling of the imminent change in the offing. Had the images of

Rs.500 and Rs.1000 notes been circulated instead of/ alongside the images of

Rs.2000 notes there would have been a scramble for dumping the black money and

the exercise could have met a different kind of success.

2.

Such

kind of change in currency notes as and when warranted in the future should happen

regularly to keep in check the growth of the parallel economy taking into account

the comparison of lost taxes (revenues for the government) due to a thriving

parallel economy vis-à-vis the cost of issuing different currency notes.

Congratulations Mr. Donald Trump and Mr. Modi

for the new initiatives that will bring in the much wanted and desired results.

As someone has rightly said, “The markets may fail but the human beings should

not.”

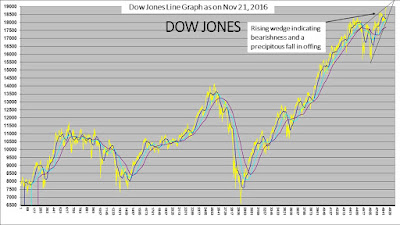

My views

in my previously authored articles remain intact irrespective of whatever

recent developments might have taken place in the US and the Indian financial

markets.

DISCLAIMER:

These

extracts from my trading books are for educational purposes only. Any advice

contained therein is provided for the general information of readers and does

not have regard to any particular person's investment objectives, financial

situation or needs and must not be construed as advice to buy, hold and sell or

otherwise deal in any kind of commodities, currencies, securities or other

investments. Accordingly, no reader should act on the basis of any information

contained therein without first having consulted a suitably qualified financial

advisor.