I always

say that the stock markets are always the same. This time they are a bit

different in a limited sense only. But surely whenever they fall, they leave

investors with the same emotions each time.

This time

the stock markets are different because of some of the factors listed below:

a)

There

is a huge liquidity in the market caused by domestic inflows of mutual funds (which

is there every time) but this time the figures are being rolled out - something

like a specific feature/ technology of a product being used as a USP for

selling it.

b)

The

general investors are so optimistic about the bullishness of the markets that

they have stopped believing that the markets will ever fall. The S shaped cycle

models have been successfully deleted out of the mind and memory of the

investors and from the books of economics and marketing. Instead the disruptive

valuation models are masking the true state of affairs of the markets and

economies world over. The PE ratios and growth rates have lost their relevance

or are at an acceptable stretched levels as per the newer norms of the global

economies.

c)

The

markets have been moving and inching up gradually. Each dip in the past has led

to a bounce back higher than the previous highs and the markets have moved on

thus.

d)

Every

investor is upbeat about the mutual funds keeping the markets afloat and each

mutual fund investor has become savvy about investment jargons like SIP and

STP. Honestly there may be a few more that I am not familiar with.

e)

Factors

like geo-political and economic tensions in Asia (North Korea and South China

Sea), Middle East (ISIS and attacks in Syria) and Europe (potential financial

default by Greece, annexation of Crimea), just to name a few have been ignored by

the stock markets or speaking in a reverse sense, the stock markets and fund

managers have never let these events affect the markets. Any negative news on

the stock markets has been effectively managed by the media/ respective

governments.

This time

the paanwalas will not be given the privilege to determine the time of fall of

the stocks. It is a general saying in the stock market circles that when the

paanwalas start giving stock tips to their customers, it is time to exit the

markets.

But this

time around, the growth story of India is being attributed to two recently

undertaken initiatives of demonetisation and GST by the government. These

initiatives will definitely turn in positive results for the economy in times

to come, but labelling these initiatives as USPs for the growth story is

something which is a matter of concern. These measures will bring in improved transparency,

good governance and gradual alignment of the unorganised sector/ parallel

economy with the mainstream economy.

If vague

factors like Digital India/ Start-ups, demonetisation, GST and may be a few

more can be termed as the key differentiators of the growth story of India,

probably there could be as many other vague factors/ triggers for the bearishness

of the Indian indices.

However,

there are a few factors which cannot be afforded to be ignored:

1.

Month

after month, the foreign money is being pulled out of the Indian stock markets

in big quantum. One gets to hear arguments that the Indian mutual funds (please

refer to point no. d) above) are pouring in thousands of crores of money into

the stock markets.

We are by any standards still very small in

comparison to the amount of money invested in India by the Foreign Institutional

Investors (FIIs).

2.

A

highly probable rupee strengthening (media and news reports speak of contrary)

can shave off extra margins from the export earnings of the industry. The

software giants may see a straight impact on the EBIDTA margins. For example, a

5% hardening of rupee against USD, will straight away knock off EBIDTA margins of

exports/ USD earnings by 5%. This may or may not happen.

3.

A

0.25% increase in interest rates by Fed this year and expected four straight

increases in 2018 might lead to a stagnation in the housing sector of the US

due to increase in the EMIs (lower disposable income) and in the industrial/

commercial sector due to increased cost of capital, higher payback periods of

projects, lower borrowing capacity due to fall in interest coverage ratios, lower

capital expenditure by corporates, etc.

A third increase of 0.25% during 2017 is on the

cards in the current quarter and the Fed has already indicated unwinding of the

balance sheet (shedding off its assets) in a planned and predictable manner

starting October 2017.

The Tax

reforms passed by the Trump administration, as seen by the performance of the

indices, have failed to enthuse the markets.

The next meeting

of Fed is scheduled for December 12-13, next week. It will be interesting to

see what direction do US and other global indices take post conclusion of the

meetings and announcement of the policy decisions by Fed (announcement of the expected

interest rate hike).

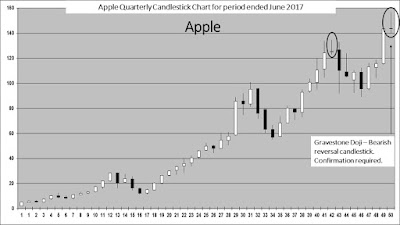

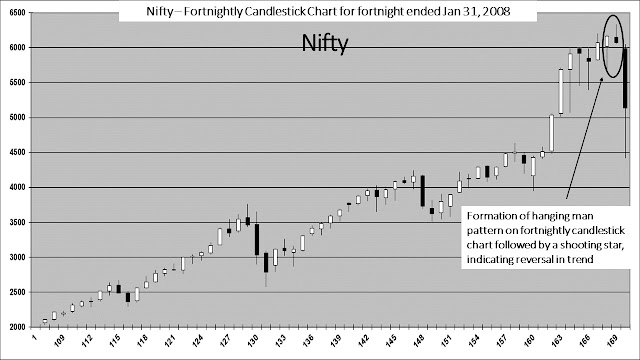

Two different

variants of NIFTY multi-period candlestick

charts have been given below for the readers to take clue from.

For the

two multi-period candlestick charts (two monthly) shown above, there is one which

coincides with calendar months and the other one which doesn’t. Both the charts

indicate bearishness. The last candle on the chart where the multi-period

candle coincides with the calendar months gives enough indications of

bearishness of Nifty. If NIFTY goes down, it confirms bearishness. If it

bounces back and goes back to the opening point or above that, it forms a hanging-man

pattern, which is again a bearish indicator.

Best

wishes to the readers for the festive season and New Year.

The

author can be contacted at: riskadvisory@outlook.com.

DISCLAIMER:

These extracts from my trading files are for

the purpose of education only. Any advice contained therein is provided for the

general information of readers and does not have regard to any particular

person's investment objectives, financial situation or needs and must not be

construed as an advice to buy, hold and sell or otherwise deal in commodities,

currencies, indices, securities or other forms of investments. Accordingly, no

reader should act on the basis of any information contained therein without

consulting a suitably qualified financial advisor in the first place.