Dow Makes a Doji

With the

US ‘armada’ and nuclear powered USS Carl Vinson stationed at South Korea, the

message to North Korea is loud and clear: “Don’t mess up with USA”.

North

Korea has so far very recently had two failed missile tests. Was it an act of

sabotage or the result of the US deployed THAAD (Terminal High Altitude Area

Defence) System in South Korea that disabled the missiles at the launch stage

itself?

With the

presence of the fleet of US Navy in the peninsular region, quietening of North

Korea, who has been testing missiles and conducting nuclear tests for past two

decades and who has been openly challenging its neighbours including USA and Japan,

will lead to a tacit acceptance of intimidation, but the fact that two missile

tests were conducted (whether successful or failed) despite the repeated warnings

from the US indicates that North Korea goes undeterred.

US in

turn has imposed sanctions and has asked its allies to cooperate.

My

concern is that if these two missile tests would have been successful, what

would have been the results. Would it have provoked the US naval fleet to

intercept? Could this have led to a conflict and a subsequent war?

Meanwhile

there have been reports and news about the mystic named Horacio Villegas who

has prophesied about breaking of nuclear war on May 13, 2017. This prophecy is

dated April 17, 2017.

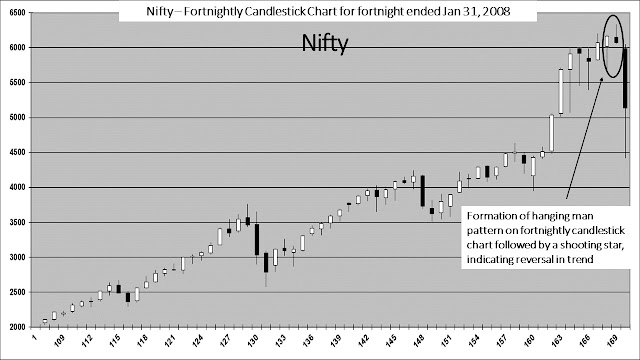

On the

front of the financial markets, all stock indices have made higher highs during

the last week totally defying and going undeterred by the abovementioned

geopolitical developments. None of the indices except Dow has made any

candlestick pattern indicating bearishness, though all the technical indicators

have shown divergence, indicating bearishness.

There

have also been reports that Nifty is going to touch/ cross 10000 by December and

that is just 7% away from the current level. Interesting enough!

Given below

is the two monthly candlestick chart of Dow which has made a Doji in the form similar

to a ‘Hanging Man.’ A Doji or a Hanging Man (slightly different from a Doji because

it has a real body which is atleast half the size of its lower shadow) is

formed at the top of the market. These patterns indicate trend reversal. While

a confirmation is required on the candlestick charts to confirm bearishness,

this time around a confirmation will perhaps be too expensive for the stock

markets.

On the

other hand, despite whatever the US influential bigwigs of the financial markets

may have indicated about bullion, gold and silver are geared up for a long term

bull run.

The

author can be contacted at: riskadvisory@outlook.com.

DISCLAIMER: