Crude Oil – WTI (INR and USD)

Talks are

abuzz that Crude Oil is going to fall further. There is news that there may be far

excess supply in 2016 than what the global markets may be able to absorb and

that the crude carrying ships are being used as storage capacities and crude is

being ferried to the farthest destinations so as to increase the transit time

for very well-known reasons.

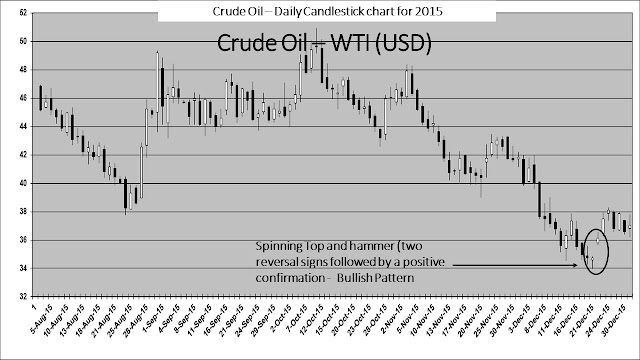

However the

most recent candlestick chart patterns of WTI (INR and USD) have thrown up some

surprises. While a few of them have been followed by positive confirmations, a

positive confirmation is yet to follow on fortnightly and monthly candlestick

charts (INR and USD).

The adapted Bollinger

Bands do not yet give any indication of formation of a squeeze and a consequent

reversal of trend, yet it seems after combining all the above factors that

Crude Oil is in a consolidative phase and at least for now the rates have stabilised.

A bullish

phase would be confirmed with the formation of a white candle on the monthly

candlestick charts and with the initiation of the formation of a squeeze on

adapted Bollinger Bands.

Best wishes for the New Year 2016.

Contact:

The author can be contacted at: riskadvisory@outlook.com.

Disclaimer:

These extracts from my trading books are for educational purposes only. Any

advice contained therein is provided for the general information of readers and

does not have regard to any particular person's investment objectives,

financial situation or needs and must not be construed as advice to buy, sell,

hold or otherwise deal with any commodities, currencies, securities or other

investments. Accordingly, no reader should act on the basis of any information

contained therein without first having consulted a suitably qualified financial

advisor.